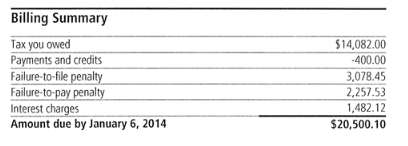

You may not be surprised to hear that the IRS and other local taxing authorities have hundreds of potential penalties that can be assessed to taxpayers, and they all come with interest. However, you may be surprised to learn that there are just as many avenues to remove or reduce these penalties and interest. Some of the more common ones include reasonable cause relief, first time abatement relief, disaster relief, recalculation under the annualized installment method, and other avenues depending on the penalty that is assessed.

Additionally, if you have years of unfiled tax returns, there are numerous programs the IRS has set up to help lighten the burden and get you back in good standing. Some of these programs include installment agreement applications, offer in compromises, and the voluntary disclosure program.

But every penalty relief request and program has specific requirements that must be met and forms that must be filed before it is granted. That’s where we can help. We’re well-versed in the requirements and can represent you before the IRS to help get you back in good standing. If you are in one of these situations, please contact us today to get started.